Business Water Price Increase

Secure Savings of up to 20% on your Business Water Rates Today

Just enter your business postcode…

Secure Savings of up to 20% on your Business Water Rates Today

Just enter your business postcode…

All business water suppliers have now published their default rates taking effect on 1 April 2025.

The table below displays the published price increases, illustrating the impact on a small company paying default water rates based on an annual usage of 120 cubic metres (equivalent to the average household).

| Wholesale region | Default supplier | 24/25 | 25/26 | Increase | Increase % |

|---|---|---|---|---|---|

| Scottish water | Business Stream | £661 | £727 | £66 | 10% |

| Anglian Water | Wave Utilities | £677 | £778 | £102 | 15% |

| Northumbrian Water | Wave Utilities | £622 | £727 | £105 | 17% |

| Severn Trent Water | Water Plus | £583 | £706 | £123 | 21% |

| South West Water | Source for Business | £874 | £1,086 | £212 | 24% |

| Southern Water | Business Stream | £709 | £998 | £289 | 41% |

| Thames Water | Castle Water | £567 | £712 | £145 | 26% |

| United Utilities Water | Water Plus | £709 | £861 | £142 | 20% |

| Wessex Water | Water 2 Business | £735 | £860 | £125 | 17% |

| Yorkshire Water | Business Stream | £638 | £782 | £144 | 23% |

In compiling the above data, we assumed:

For more information about rates in your region, visit our business water rates calculator.

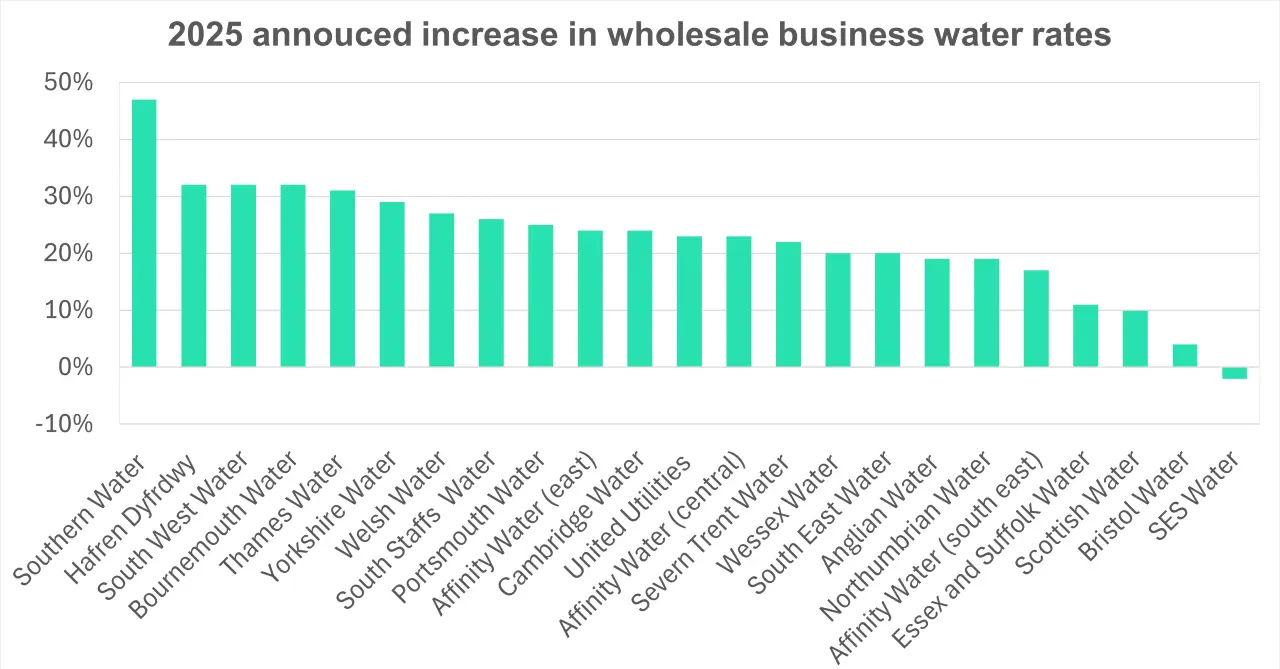

Publications from Ofwat show the final determination of the wholesale water price rise for April 2025.

Ofwat has allowed significant increases in water rates across all regions to fund investment in water infrastructure over the next five years.

Since wholesale rates account for the majority of business water bills, these determinations have caused the significant increase in business water rates in 2025.

The business water price increase figures published above apply to default business water rates, which approximately 80% of British businesses pay.

In the deregulated water market for England and Wales, businesses can mitigate these price rises by securing a cheaper fixed water tariff with a more competitive supplier.

At AquaSwitch, we specialise in helping companies compare business water rates to find a more cost-effective tariff. Simply enter a few details about your business in our form above to discover how much your business could save today.

In this section, we’ll summarise the two key reasons behind the significant increases in business water rates in 2025.

In December 2024, Ofwat approved a £104 billion investment in infrastructure by local water companies for the next five years.

This large-scale investment in water infrastructure is being funded through significant increases in both domestic and business water rates.

This planned investment will fund the following long-term initiatives:

Ofwat approves a separate investment plan for each local water company, which explains why some regions are experiencing significantly higher price increases than others.

Retail fees are the additional charges business water suppliers apply for providing customer services, water meter readings, and billing.

Increases in retail fees are closely regulated by Ofwat, which has published its permitted adjustment for 2025–26, outlining the maximum retail fee suppliers can charge.

Ofwat has approved an 8% inflationary increase in the retail price cap for 2025. See below for more information on how the retail business water price cap works.

Since deregulation in 2017, English businesses have been able to switch business water suppliers and secure a fixed, lower retail fee with any supplier in the market.

However, approximately 80% of English businesses have never switched suppliers, so they pay the “default business water tariffs” set by the default water supplier in their region.

Ofwat, the regulatory body, closely controls these default retail rates, imposing a price cap to safeguard businesses that have not switched suppliers and to limit the price rise each year.

The default business water rates incorporate underlying wholesale price rise plus increases in the retail fee. The default water supplier in each region publishes their default rates online.

Typically, default water suppliers charge the maximum permitted under the default price cap, meaning the establishment of this cap has a direct impact on most businesses.

For further reading we have a dedicated article explaining the price control approach of Ofwat and Ofgem.

The Retail Exit Code defines a maximum that can be charged to the following two groups of business water customers on the default contract.

The Retail Exit Code safeguards 99% of businesses in the commercial water market, excluding only high industrial users. It is presumed that these high-use businesses, due to their significant expenditure on water, will self-manage the negotiation of water contracts.

The Retail Exit Code calculates the maximum retail business water rates that can be charged as follows:

The Retail Exit Code outlines the method for calculating the maximum retail business water rates that can be charged to small commercial users of water, as follows:

Allowed Retail Cost per Customer + Net Margin + Allowed Bad Debt Allowance

The Retail Exit Code limits the retail business water rates that can be charged under a default contract for medium-sized commercial users of water to:

Here’s a typical example of a Group One customer to demonstrate how the Retail Exit Code gets applied in practice.

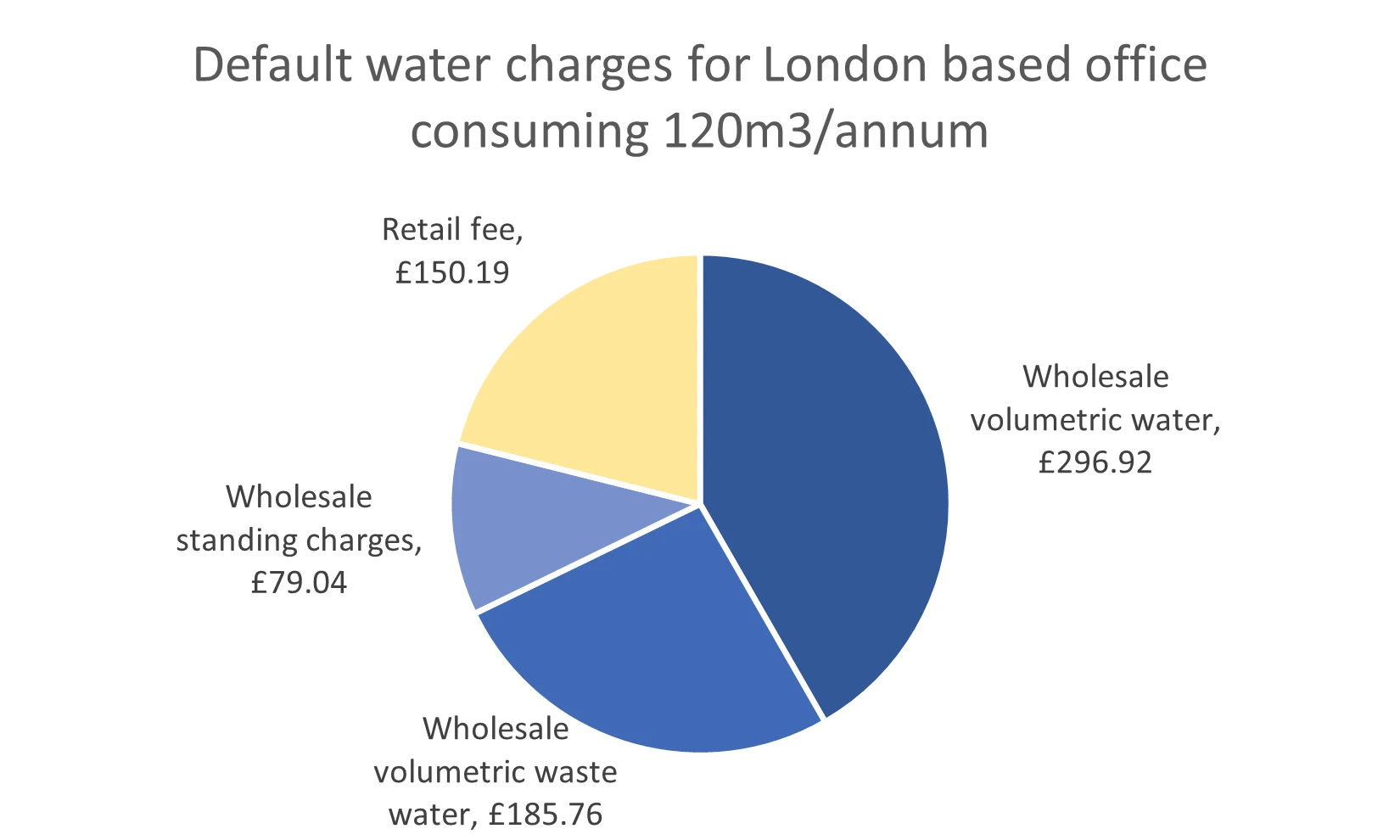

A small London-based office that consumes 120 cubic meters of water annually (about the same as the average household). If the office pays water under a deemed contract, they’ll pay Castle Water (the default supplier in the Thames Water area) £712 each year, broken down into the following:

Source: Thames Water wholesale rates and Castle Water scheme of charges.

Thames Water levies wholesale water fees (in blue) for operating and maintaining the water infrastructure that delivers fresh water and removes wastewater from the office.

The yellow retail fee of £150.19 is the default charge levied by Castle Water for their work of conducting meter readings, providing customer services and billing the customer. The £150.19 represents the maximum that Castle Water can charge under Group One rules within the Retail Exit Code.