Business Water Price Increase 2024

Secure Savings of up to 20% on your Business Water Rates Today

Just enter your business postcode…

Secure Savings of up to 20% on your Business Water Rates Today

Just enter your business postcode…

The last twelve months have proved challenging for the British water industry, which has attracted significant media scrutiny due to water companies discharging wastewater into rivers during times of sewer overflow.

In response to this escalating issue and the ongoing challenges posed by a warming climate, water companies are committing unprecedented funds towards enhancing the British water infrastructure.

To finance this additional investment, on the first of April, British businesses received an average increase of 9% in water costs.

The regional business water rates for 2024/25 have now been announced. Read on to find out what this means for your business.

Contents

💡Your business can avoid the 2024 water price rise and achieve immediate savings by agreeing to fixed water rates through our business water comparison service.

Our business water experts have crunched the numbers for the April 2024 business water price increase.

The following table summarises the impact for a small company paying default water rates based on an annual usage of 120 cubic metres of water (approximately the same as the average household).

| Wholesale region | Default supplier | 23/24 | 24/25 | Increase | Increase % |

|---|---|---|---|---|---|

| Scottish water | Business Stream | £608 | £661 | £53 | 8.8% |

| Anglian Water | Wave | £630 | £677 | £47 | 7.5% |

| Northumbrian Water | Wave | £550 | £622 | £72 | 13.0% |

| Severn Trent Water | Water Plus | £542 | £583 | £41 | 7.5% |

| South West Water | Source for Business | £807 | £874 | £67 | 8.3% |

| Southern Water | Business Stream | £627 | £709 | £82 | 13.0% |

| Thames Water | Castle Water | £519 | £567 | £48 | 9.3% |

| United Utilities Water | Water Plus | £655 | £709 | £54 | 8.3% |

| Wessex Water | Water 2 Business | £669 | £735 | £66 | 9.8% |

| Yorkshire Water | Business Stream | £587 | £638 | £51 | 8.8% |

In compiling the above data, we assumed:

Here’s a link to our business water rates calculator, which will give you an exact breakdown of your company’s 2024/25 rates.

Business water rates comprise the underlying wholesale water rates and the retail fee charged by business water suppliers.

Both components increased in price on 1 April 2024, contributing to an average 9% increase in small business water rates. However, there are significant regional variations. Let’s explore both.

Wholesale water rates are the charges levied by the local water company for providing a supply of potable water and for operating the local water and sewerage infrastructure.

These rates are closely regulated by Ofwat and have been approved for the 2024-25 year, resulting in an average increase of 6.1%. Significant regional variations exist in the rate changes, attributable to the investment plans of each individual water company, with some areas even seeing reductions in charges.

Although the precise increase will depend on your specific business water tariff type, the expectations for the average increase are as follows:

| Region | 2024 wholesale price rise |

|---|---|

| Anglian | 8.2% |

| Welsh Water | -3.9% |

| Hafren Dyfrdwy | 19.6% |

| Northumbrian | 9.0% |

| Severn Trent | 6.6% |

| South West | -0.4% |

| Southern | 11.9% |

| Thames | 3.3% |

| United Utilities | 7.8% |

| Wessex | 12.1% |

| Yorkshire | 6.1% |

| Scotland | 8.0% |

| Average: | 6.1% |

Sources:

Retail fees are the additional amount charged by the business water suppliers for their role of providing customer services, meter readings and billing to their customers.

Increases in retail fees are closely controlled by Ofwat, who have published their permitted adjustment for 2024-25.

The Ofwat price cap on retail fees involves a complex mechanism (expanded upon below), but a typical small business consuming 120 cubic metres of water (approximately the same as the average household) saw its retail fee increase by 11.5% from 1 April 2024.

💡 The Welsh water market is not deregulated, meaning businesses in Wales are only affected by the increases in wholesale water rates.

Since deregulation in 2017, English businesses have been able to switch business water suppliers and secure a fixed, lower retail fee with any supplier in the market.

However, approximately 80% of English businesses have never switched suppliers, so they pay the “default business water tariffs” set by the default water supplier in their region.

Ofwat, the regulatory body, closely controls these default retail rates, imposing a price cap to safeguard businesses that have not switched suppliers and to limit the price rise each year.

The default business water rates incorporate underlying wholesale price rise plus increases in the retail fee. The default water supplier in each region publishes their default rates online.

Typically, default water suppliers charge the maximum permitted under the default price cap, meaning the establishment of this cap has a direct impact on most businesses.

The Retail Exit Code defines a maximum that can be charged to the following two groups of business water customers on the default contract.

The Retail Exit Code safeguards 99% of businesses in the commercial water market, excluding only high industrial users. It is presumed that these high-use businesses, due to their significant expenditure on water, will self-manage the negotiation of water contracts.

The Retail Exit Code calculates the maximum retail business water rates that can be charged as follows:

The Retail Exit Code outlines the method for calculating the maximum retail business water rates that can be charged to small commercial users of water, as follows:

Allowed Retail Cost per Customer + Net Margin + Allowed Bad Debt Allowance

The Retail Exit Code limits the retail business water rates that can be charged under a default contract for medium-sized commercial users of water to:

Here’s a typical example of a Group One customer to demonstrate how the Retail Exit Code gets applied in practice.

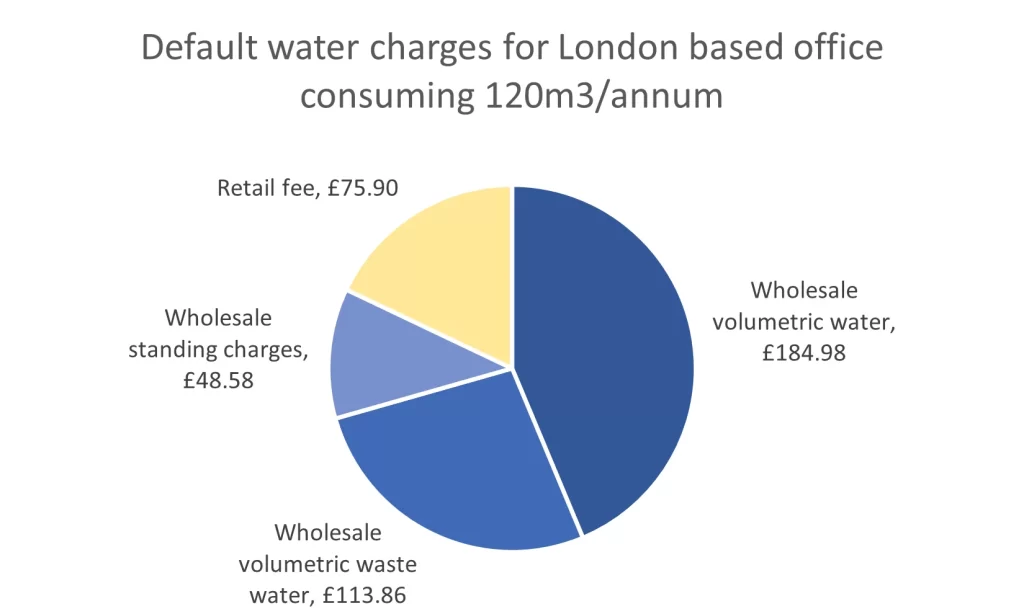

A small London-based office that consumes 120 cubic meters of water annually (about the same as the average household). If the office pays water under a deemed contract, they’ll pay Castle Water (the default supplier in the Thames Water area) £423 each year, broken down into the following:

Source: Thames Water wholesale rates and Castle Water scheme of charges.

Thames Water levies wholesale water fees (in blue) for operating and maintaining the water infrastructure that delivers fresh water and removes wastewater from the office.

The yellow retail fee of £75.90 is the default charge levied by Castle Water for their work of conducting meter readings, providing customer services and billing the customer. The £75.90 represents the maximum that Castle Water can charge under Group One rules within the Retail Exit Code.

The key question is whether the £75.90 is sufficient for Castle Water to perform its duties as a business water supplier. As we’ll see in the next section, there are significant differences in how high the parties think this default retail fee should be.

Ofwat, the economic regulator for the water sector, plays a pivotal role in the process of determining business water price rises, imposing strict limits on the charges that business water suppliers can apply to default contracts.

This approach stands in stark contrast to that of Ofgem, which exercises only limited control over business electricity prices and commercial gas rates.

Within the water industry, several groups hold differing opinions on these price controls. Let’s explore each perspective.

Ofwat recognises the absence of effective competition in the business water market, particularly for small businesses.

Given this lack of competition, Ofwat argues that the current price cap mechanism is both appropriate and essential. This is to ensure that smaller business customers are protected from paying prices that do not accurately reflect the costs or the quality of service they receive.

The UK Water Retailer Council, consisting of business water suppliers in the deregulated market, has commissioned a report analysing the effectiveness of regulation in the non-household water market.

This report suggests that the maximum price cap for Group One should be significantly raised. It posits that the costs incurred in serving the smallest customers far exceed the retail fees that can currently be charged under the existing framework.

Consequently, the Council recommends a revision of the Retail Exit Code to allow for a 55% increase in the Allowed Retail Cost per Customer.

The Strategic Panel is a group formed of representatives from Wholesalers, Business water suppliers, Independents and representatives from Ofwat and MOSL that seeks to provide strategic direction to improve outcomes for non-household customers.

The Strategic Panel has previously set out its view that “current price caps are, in all regions, set too low to allow competition for Group One customers with any retailer.” The Strategic Panel recommends a loosening or lifting of REC price controls for group one customers.

The Panel further states that the current price controls are increasing the risk of incumbent business water supplier bankruptcy as margins for suppliers for Group One customers are so low.

AquaSwitch operates as a third-party intermediary (TPI) in the commercial water market. We work with suppliers from across the market and have helped thousands of companies compare business water suppliers and switch to a cheaper tariff.

Ben Brading, founder of AquaSwitch, provides his view on the current price control for Group One customers:

In a well-functioning market, suppliers compete for new customers by providing the best service at the lowest price.

“In a well-functioning market, suppliers should be vying for new customers by offering the best service at the most competitive price. However, this dynamic is absent for 85% of the market, which is comprised of smaller businesses.

Many incumbent business water suppliers exert minimal effort to attract Group One customers, primarily because serving them is not financially viable under the existing price controls.

When the goal is neither attracting new customers nor retaining existing ones, service levels inevitably decline.

We concur with the Strategic Panel’s recommendation that easing the price controls for Group One customers is essential to realise the full advantages of water market deregulation.”