Energy Bill Discount Scheme

The Energy Bill Discount Scheme (EBDS) was a government scheme designed to automatically discount expensive business electricity and gas tariffs during the energy crisis.

This article explores everything business owners need about the Energy Bill Discount Scheme.

💡 The Energy Bill Discount Scheme ended on 31 March 2024 and has not been replaced. In the absence of government support, we recommend you compare business energy prices to get the best deal.

Contents

- What’s the Energy Bill Discount Scheme (EBDS)?

- What’s changing in the government support for business energy?

- Why most companies didn’t benefit from the Energy Bill Discount Scheme

- Key details of the Energy Bills Discount Scheme

- Do businesses get help with energy bills?

What’s the Energy Bill Discount Scheme (EBDS)?

It was a government scheme that applied a baseline automatic discount on energy bills (electricity and gas) for eligible non-domestic customers in Great Britain and Northern Ireland.

The discount was applied on a per-unit basis during the 12-month period from April 2023 to March 2024 only if prices go above a certain threshold.

There are also two additional discounts that need applying for, one for “Energy and Trade Intensive Industries” and another for “heat networks with domestic end consumers”.

The scheme was established as part of the Energy Prices Act, which was enacted in 2022 to combat the energy crisis of the same year.

For more information, visit the Government’s Energy Bill Discount Scheme page.

What’s changing in the government support for business energy?

The Energy Bill Discount Scheme replaced the Energy Bill Relief Scheme, which ended in March 2023.

Before diving into the key details of the Energy Bill Discount Scheme, let’s explore the key difference between the two government business energy support schemes.

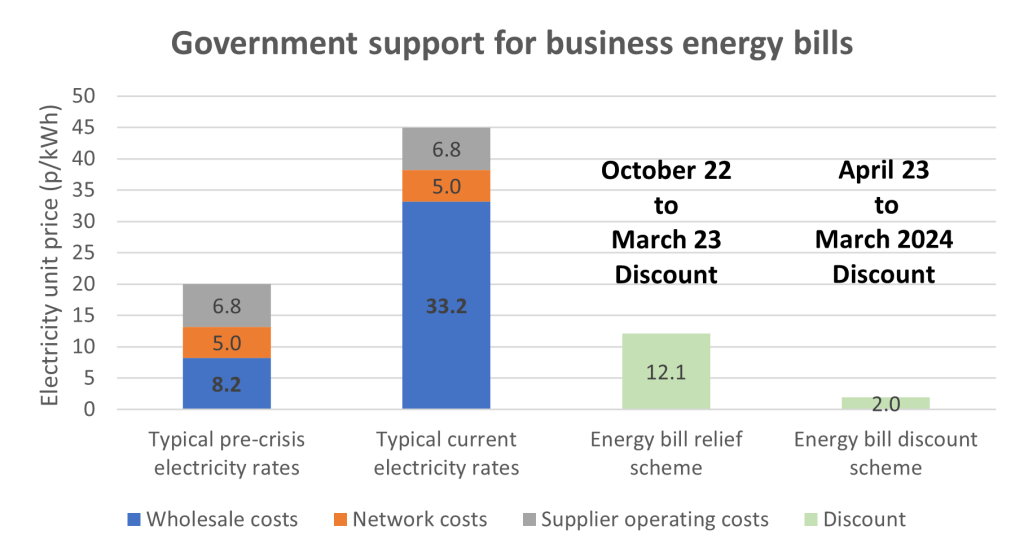

Here’s a graphical comparison of discounts offered by the two schemes:

The energy bill discount scheme is significantly less generous. In the example of a typical pub set out on the gov.uk, a discount under the old scheme of £3,100 per month would be typical. Under the new scheme, that same pub will receive a discount of just £189 each month.

What’s more, this discount is a maximum figure; let’s explore why most businesses won’t benefit from any discount under the new scheme.

Why most companies didn’t benefit from the Energy Bill Discount Scheme

The Energy Bill Discount Scheme only kicked in if the wholesale rates of electricity and gas exceeded the following:

- 30.2p/kWh for electricity; or

- 10.7p/kWh for gas

Under this level, the scheme did not discount business energy bills.

Since January 2023, wholesale electricity and gas rates have fallen below the threshold of the automatic discount.

The easing of wholesale energy costs is, of course, good news for businesses. There are significantly cheaper energy rates now on offer in the market. Get the latest quotes for your company with our business electricity prices and business gas comparison tools.

Key details of the Energy Bills Discount Scheme

Here are the key details you need to know about the Energy Bills Discount Scheme:

Energy Bills Discount Scheme dates

The Energy Bill Discount Scheme applied to bills in the 12 months from 1 April 2023 to 31 March 2024.

Energy Bills Discount Scheme eligibility

The Energy Bill Discount Scheme applied to all non-household properties, including businesses, charities, other organisations, and even small business energy prices.

The one exception is fixed-price energy tariffs agreed on before 1 December 2021, but this is a moot point because energy prices were significantly lower then. You’ve been very lucky if you still have a fixed energy contract from before 2022.

Discounts available under the Energy Bill Discount Scheme

You only received a discount under the scheme if the wholesale element of your current energy tariff exceeds the following:

- 30.20p/kWh of electricity

- 10.7p/kWh of gas

The discount was calculated as any cost greater than these thresholds, up to a maximum discount of:

- 1.961p/kWh of electricity

- 0.697p/kWh of gas

It’s worth remembering that the wholesale charge is only one component of your energy bill.

How do you apply for the Energy Bill Discount Scheme?

You don’t; the Energy Bill Discount Scheme is automatic. Your business energy supplier automatically calculated and applied the discount to your electricity and gas bills.

Comparing business energy with the discount scheme

The Energy Bill Discount Scheme is applied automatically regardless of your business energy supplier or current electricity and gas tariffs.

Unlike its predecessor, the Energy Bill Discount Scheme only provided a small discount to businesses. It’s really important to ensure your company is signed up for a competitive deal with your business energy supplier.

If you’re approaching the end of a business energy contract or are currently out of contract, we recommend comparing the energy market to see what’s available.

Use our business energy comparison service to get quotes tailored to your business today.

Do businesses get help with energy bills?

The government supported businesses through the Energy Bill Discount Scheme until March 2024. The scheme automatically discounted business energy bills for companies on the most expensive fixed-rate energy tariffs.

The Energy Bill Discount Scheme has since ended and has not been replaced.

For details on the regulatory support available on business energy bills, refer to our guide to the business energy price cap.

Energy Bill Discount Scheme – FAQs

Here are the additional things business energy owners are asking about the current government scheme supporting business electricity rates and commercial gas prices.

How much will the Energy Bill Discount Scheme cost?

The Energy Bill Discount Scheme has been designed to be much cheaper for the government.

According to a government announcement on 9 January 2023, the scheme balances supporting businesses and limiting the taxpayer’s exposure to volatile energy markets. The scheme was estimated to cost £5.5bn, significantly cheaper than the £18bn spent on the more generous Energy Bill Discount Scheme.

Does the Energy Price Guarantee apply to businesses?

No, the Energy Price Guarantee applies only to home electricity and gas.

The Energy Bill Discount Scheme and the Energy Bill Relief Scheme apply to any property that isn’t household.