Government scheme for business energy bills: Everything you need to know

UPDATE: The Energy Bill Relief Scheme ended on 1 April 2023. The scheme was replaced by the Energy Bill Discount Scheme.

Homes and businesses across Britain are facing a difficult winter. Russia has shut off its natural gas pipelines into Europe to punish the West for providing economic and military support to Ukraine.

Britain relies on natural gas to generate electricity at power stations and heat with traditional boilers. There simply isn’t enough gas supply to meet the demand, and energy prices have soared.

On 1 October 2022, the British government will intervene to protect businesses from soaring energy costs. The government scheme for business energy bills is called the Energy Bill Relief Scheme.

In this article, we explain everything you need to know about the government scheme for business energy bills:

Contents

- What is the government scheme for business energy bills?

- Business energy price cap

- Who is eligible for government support on energy bills?

- How does the government scheme for business energy bills work?

- Which business energy tariffs receive the energy bill discount?

- Should I compare business energy suppliers?

- Reactions to the government’s scheme for business energy bills

- Energy Bill Discount Scheme

- How do I get the Energy Relief Scheme?

- Which business types are excluded from the Energy Relief Scheme?

- What will happen when the Energy Bill Relief Scheme ends?

- When does the Energy Bill Relief Scheme start?

- Does the energy price cap apply to business?

- Is there a business energy price cap?

- What’s the difference between the Energy Bill Relief Scheme and the Energy Price Guarantee?

- Should I agree on an energy contract?

- How much is my business electricity discount?

- How much is my business gas discount?

- Sources

What is the government scheme for business energy bills?

The government scheme for business energy bills is known as the Energy Relief Scheme. It’s a UK government intervention into the business energy market that protects non-households from the astronomical wholesale market energy costs expected during the coming winter of 2022/23.

Starting on 1 October 2022, for six months, discounts will be applied to business energy bills to cap the wholesale cost of electricity and gas.

The scheme will apply to the supply of electricity and gas to the vast majority of non-household properties (i.e. businesses, charities and all other organisations).

Business energy price cap

Households across Britain are protected by an energy price cap, a scheme which sets a ceiling for how much energy suppliers can charge their customers. There is no equivalent business energy price cap.

However, the Business Energy Relief Scheme gives similar support for commercial and other non-household properties protecting them from the soaring wholesale cost of electricity and gas.

Who is eligible for government support on energy bills?

All properties will receive government support this winter through artificially low energy bills.

The government has two support schemes; the one you’ll receive will depend on whether your property is a home or something else (non-household).

- Home energy relief: The energy bill people receive for their homes will be protected by the Energy Price Guarantee. The Energy Price Guarantee is an energy price cap that will limit energy rates so that the average annual dual-fuel bill will be £2,500 for the next two years.

- All other properties: Energy supplied to all other properties, including businesses, charities and all other organisations, are covered under the Energy Bill Relief Scheme.

How does the government scheme for business energy bills work?

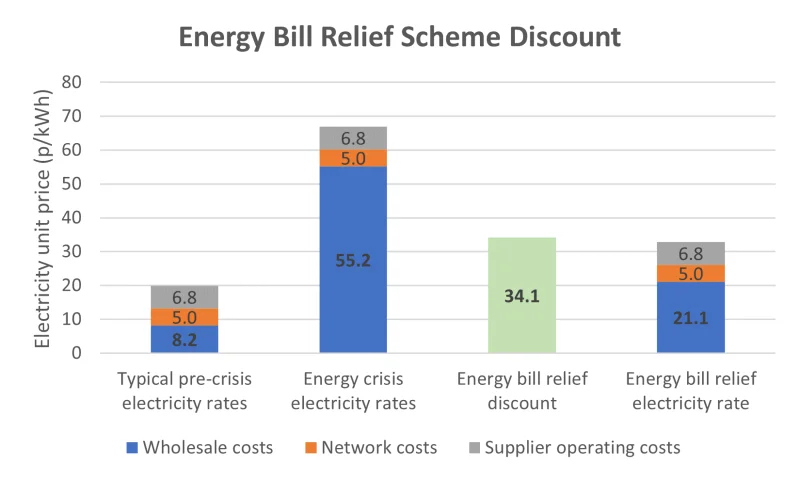

Here’s where it gets a little complicated. The Energy Bill Relief Scheme discounts the amount your business, charity or organisation pays per kWh (p/kWh) of electricity and gas.

However, the discount doesn’t apply to the overall charge per kWh but does so just to the wholesale element of your rates.

This contrasts the household energy cap, which is applied to the grand total amount, including network costs and supplier operating costs.

The unit charge you pay on your business energy bill includes several separate costs:

- Wholesale charges: The amount your business energy supplier pays for buying your electricity and gas from producers/importers.

- Network costs: The cost of moving electricity and gas to your property through the local electricity and gas distribution networks.

- Supplier operating costs: The cost of maintaining the customer services department, billing, providing and reading business energy meters and other corporate functions.

The energy bill relief discount will apply only to the wholesale element of your unit rates. The discount will reduce the wholesale element to:

- Electricity: 21.1 p/kWh

- Gas: 7.5 p/kWh

To try and demonstrate, below is a handy graph showing the make-up of a typical business electricity bill before the energy crisis and now.

The wholesale element of the bill (in blue) has increased exponentially during the crisis.

The Energy Bill Relief Scheme discount will reduce this element to a more manageable price of 21.1p/kWh, regardless of the actual wholesale rates in your energy tariff.

The relief is expected to be around 40% of your overall bill at current wholesale energy prices (see graph).

Which business energy tariffs receive the energy bill discount?

The energy bill relief scheme protects all companies regardless of their business energy tariff and contract status. All of the following tariffs are included within the scheme:

- Fixed term tariffs

- Fixed-rate tariffs

- Variable tariffs

- Default tariffs

- Out-of-contract tariff

- Flexible tariffs

The scheme excludes fixed-rate tariffs agreed on before 1 December 2021.

However, this is a moot point because, before this date, the wholesale energy rates were below the scheme’s discounted wholesale unit rates.

For more information on commercial electricity rates, check out our complete guides to business electricity prices and small business energy.

Should I compare business energy suppliers?

The energy bill relief discount will be applied to your business energy bill regardless of which tariff and supplier you get your energy from.

Since the energy relief only impacts your bill’s wholesale element, energy suppliers continue to compete to offer the best prices.

Get energy quotes for your business today with our business energy comparison service.

Reactions to the government scheme for business energy bills

Understandably, news outlets provide daily coverage of the ongoing energy crisis and its impact on people nationwide.

The government’s intervention in household and non-household energy markets is widely considered inevitable to avoid mass hardship and commercial bankruptcies.

However, the support has come under some criticism from economists, including at the World Bank, for the following reasons:

- A lack of price signal: The root problem we’re facing in the Energy Crisis is that there isn’t enough natural gas to go around. Artificially reducing the wholesale price doesn’t encourage consumers to use less, which may further exacerbate the problem of rising wholesale prices.

- Increasing UK debt: The Institute of Fiscal Studies estimates that the subsidies in the energy markets could exceed £100 billion. Since the UK government is simultaneously announcing tax cuts, this will likely be paid through additional debt burdening future generations.

Energy Bill Discount Scheme

The energy bill relief scheme was always temporary as the government support has come at a huge cost to the UK treasury. On 9 January 2023, the government announced its replacement, the Energy Bill Discount Scheme.

The energy bill discount scheme will run for 12 months, from 1 April 2023 to 31 March 2024 and will apply to all businesses and organisations on all types of energy tariffs. The discount will reduce the wholesale element of business energy bills to:

Electricity – 30.2p/kWh

Gas – 10.7p/kWh

This new scheme is significantly less generous and is limited to a maximum discount of:

Electricity – 1.9p/kWh

Gas – 0.06p/kWh

As with the original energy bill relief scheme, this discount will be applied automatically. Given falling energy prices and the higher thresholds for relief, it’s likely that some businesses will not be eligible for any discount.

Some energy and trade-intensive industries will receive relief at a higher discount.

For more information check out our full guide to business electricity prices per kWh.

Energy Relief Scheme – FAQs

The government scheme for discounting business energy bills is known as the Energy Relief Scheme. Here’s our list of frequently asked questions.

Does the energy price cap apply to businesses?

No, the energy price cap only applies to electricity and gas supplied to homes. Businesses are supported by a separate scheme called the Energy Bill Relief Scheme.

The two schemes work quite differently. See above for an explanation of what support you can expect to receive.

Is there a business energy price cap?

Businesses are protected by the Energy Bill Relief Scheme, which provides support which is similar to the energy price cap that protects households.

Both schemes are designed to protect users from the skyrocketing wholesale cost of energy, but they work in different ways. Check out our article above to find out how businesses receive support under the Energy Bill Relief Scheme.

How do I get government support for business energy bills?

The discounts from the Energy Relief Scheme are automatically applied. Your business energy supplier will automatically calculate and apply the energy relief to your October bill.

Which business types are excluded from the Energy Relief Scheme?

The Energy Bill Relief Scheme will cover most businesses. Although a specific exclusion list hasn’t yet been published, the government intends to exclude companies that produce electricity and gas for the national grid.

The government also broadly warns that businesses cannot directly profit from the Energy Bill Relief Scheme other than through its intended impact of reducing costs.

What will happen when the Energy Bill Relief Scheme ends?

The Energy Bill Relief Scheme will end on 31 March 2023. The government has announced that the universal support offered by the scheme will be replaced with targeted support for vulnerable industries.

The UK Department of Business, Energy and Industrial Strategy (BEIS) has started designing the targeted energy bill relief from April 2023 onwards. The government is expected to publish the details of this support over the next months.

When does the Energy Bill Relief Scheme start?

The Energy Bill Relief Scheme will commence on 1 October 2022. For most businesses, the first time you’ll see the Energy Bill Relief Discount is when you receive your October invoice in early November.

What’s the difference between the Energy Bill Relief Scheme and the Energy Price Guarantee?

The key difference is the type of properties the schemes apply to. Home energy bills will be protected by the Energy Price Guarantee, while all other properties, including businesses, will receive a discount under the Energy Bill Relief Scheme.

The schemes operate differently but cap unit energy costs to a similar figure. The biggest difference is that the Energy Bill Relief Schemes will only protect businesses for six months, while the price guarantee will protect homes for two years.

Should I agree on an energy contract?

If you’ve recently moved into a property or come to the end of your current contract, then the government recommends that you set up a contract as normal.

You’ll benefit from the energy bill relief scheme regardless of the tariff and supplier you choose, and you’ll benefit from fixed prices once the scheme ends.

To answer your question fully, here’s our guide to Should I fix my energy 2025.

Get quotes today with AquaSwitch:

How much is my business electricity discount?

The electricity rates discount your business will receive depend on how much electricity your company uses and when you switched to your current tariff.

The government publishes weekly updates for discounts under the scheme here. The discount is applied in pence per kWh of electricity consumed and will appear separately on your October 2022 electricity bill.

The design of the energy bill relief scheme is a little complicated. Got more questions?

Here’s our complete guide to business energy suppliers:

How much is my business gas discount?

Under the energy relief scheme, companies will start receiving a discount on their business gas prices per kWh when they receive their bill for October. The discount your business will receive depends on when you agree to your current business gas tariff and is published weekly by the government here.

Find out if you can get a bigger business gas discount by comparing current tariffs in the market. Request quotes today with the AquaSwitch business gas comparison service.

Sources:

- Government publication on the Energy Bill Relief Scheme.

- Government publication on the Energy Price Guarantee.

- Breakdown of unit energy costs from Ofgem.

- Report on the Energy Price Guarantee from the Institute of Fiscal Studies.

- Report on Energy Subsidies by the World Bank.