Understanding your business energy bill

Unfortunately, paying for a commercial electricity or gas supply can be complex. Even if you own a cafe that just uses electricity, you could still receive a bill that goes on for several pages.

This article aims to explain each section of the business energy bill, providing you with the knowledge you need to not only understand what you’re being charged for but also how to reduce those costs.

This article is organised into the key sections of the bill in the order they usually appear.

Jump to the section you’re interested in.

Contents

- Business energy supply points

- Invoice details

- Tariff details

- Fuel Mix

- Consumption charges

- Other charges

- Taxes and levies

- Total due

- Payment methods

- FAQs

What’s included in your business energy bill?

Our energy experts break down the nine key sections of a business energy bill.

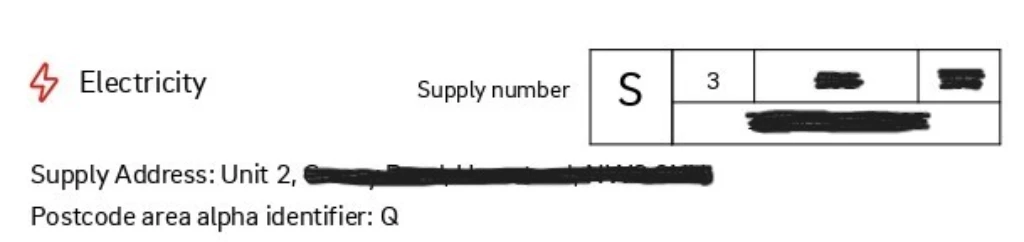

1. Business energy supply point

A business energy bill always relates to a specific business energy connection which is registered at a particular commercial property address.

On your business energy bill, your supplier will precisely clarify which supply points are being charged for by displaying the following details:

- The address of your commercial property

- Your MPAN (supply number for an electricity connection)

- Your MPRN (supply number for a gas connection)

- Your business energy meter ID

💡With a multi-site energy meter, more than one MPAN/MPRN will be shown in this section, and the charges section of the bill will be separated for each supply point.

2. Invoice details

A business energy supplier will typically invoice you once a month. Suppliers use the following identifiers to help identify a specific bill:

- Account number/Customer number – A unique number they have assigned to supply energy to your business.

- Bill number – A unique number assigned to the individual invoice.

- Bill date – The date the business energy bill was generated.

- Billing period – The period of time to which the usage and standing charges on the bill will relate. This is defined as a start and an end date.

3. Tariff details

A business energy bill will show the details of the current contract you have agreed with your supplier. This includes:

- The name of your business energy tariff

- The date the tariff comes to an end

Your supplier should also write to you between 60 and 120 days before the end of your business energy contract to let you know it is about to expire. When you receive a renewal notice, we recommend comparing business energy prices to understand how competitive your renewal quote is.

For more information, here’s our full article for business energy contracts coming to an end.

4. Tariff fuel mix

A business energy bill will display a fuel mix for your tariff. A fuel mix table shows how the energy you’ve been supplied was generated. The fuel mix will be entirely from green sources in a renewable business energy tariff.

Here’s an example of what the fuel mix disclosure will show on a business energy bill:

| Source | Standard tariff | Renewable tariff |

|---|---|---|

| Coal | 3.4% | 0.0% |

| Natural Gas | 39.3% | 0.0% |

| Nuclear | 13.9% | 0.0% |

| Renewable | 40.8% | 100.0% |

| Other | 2.6% | 0.0% |

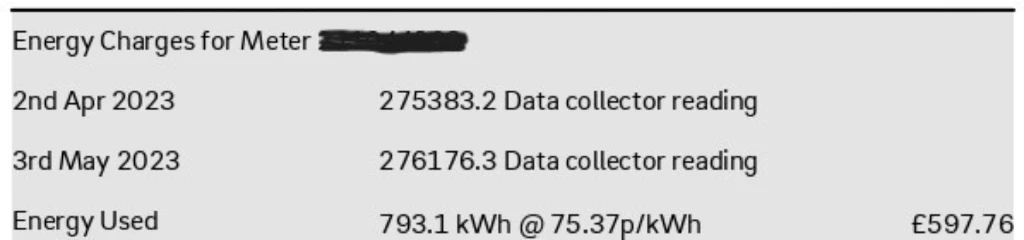

5. Business energy consumption charges

Your business energy bill will charge for the electricity and gas you’ve used during the billing period; see the invoice details section above.

In all business electricity and gas tariffs, you’ll pay for a specific unit price per kWh of electricity or gas. The number of units used in the period will measured using meter readings at your property.

Your business energy unit charge will be calculated as follows:

Unit kWh consumed during the period x Agreed unit rate

💡You’ll receive a separate calculation for peak and off-peak periods where you have a multi-rate tariff.

The business energy charges section of your bill can be complicated, so here are our full guides:

💡If you’ve got a half-hourly meter or a smart business energy meter, your reading will be automatically taken by your business energy supplier. Otherwise, these will need to be submitted manually to your supplier. Without exact meter readings, your supplier will estimate your business’s energy consumption.

6. Other business energy charges

In this section we’ll cover the other charges from your business energy supplier that will typically appear on your bill.

Standing charge

Most business energy tariffs include a daily business energy standing charge in pence per day. Your bill will calculate the standing charge for the period as follows:

Daily standing charge x Number of days in the billing period

Capacity charge

The capacity charge is another type of daily standing charge added to the electricity bill of businesses fitted with a half-hourly meter levied by your local electricity distribution network operator (“DNO”)

Your business energy supplier collects the capacity charge on behalf of your DNO as part of your business energy bill.

The charge guarantees that a certain power capacity (measured in kVA) will always be available to your business.

For more information, here’s our guide to large business energy.

Excess capacity charge

The excess capacity charge applies to the electricity supply of businesses with half-hourly meters that exceed the agreed power capacity in any half-hour during the billing period.

For more information, here’s our guide to maximum demand meters.

7. Taxes and levies

The government use the commercial energy bill as an opportunity to tax companies by introducing two charges: the climate change levy and VAT.

Climate Change Levy

Most businesses pay a climate change levy for each unit kWh of electricity and gas consumed to encourage improvements in business energy efficiency.

The current rates of the levy are 0.775 pence per kWh for both electricity and gas.

To find out more, check out our complete guide to the climate change levy.

VAT

The business energy supplier will add VAT to the consumption and other charges on your business energy bill. The VAT charged will either be at:

- The reduced rate of 5%

- The standard rate of 20%

See our complete guide on VAT for business energy.

8. Total amount due

A business energy bill will calculate how much you owe your supplier. The amount due during the billing period is calculated as the sum of:

This sum is then added to any previously unpaid balances you may have with your supplier.

9. How to pay

A business energy bill will set out the different ways you can pay your supplier. The options will usually be:

- Direct debit – Your business energy supplier has permission to instruct a payment from your bank account under a direct debit scheme. If you have a direct debit set up, your payment will occur automatically.

- BACS – A BACS payment is a manual payment method that you can instruct your bank to make. The business energy bill will show the supplier company name, sort code and account number that you will need to set up this payment.

- Debit or credit card – Some business energy suppliers will accept card payments. The supplier will provide a number of their customer services department or a link on their website to receive the payment.

A business energy bill will have a due date; this is when your supplier needs to have received the amount owed on your bill.

Business energy bill – FAQs

Now that you understand all aspects of your business energy bill, here are answers to some frequently asked questions that often follow:

How can I save money on my business energy bill?

The commercial energy market is highly competitive, with many different suppliers competing on prices. At AquaSwitch, we’ve helped companies save thousands on their business energy bills by comparing a range of deals for them.

Find out how much you can save today using the AquaSwitch business energy comparison and business gas comparison services.

Otherwise, an energy audit may help you identify areas where your business could become more efficient with its energy usage.

How much is VAT on my business energy bill?

Most businesses pay VAT on electricity and gas supplies at the standard rate of 20%. However, if any of the following apply to your business, you can request a reduced rate of VAT at 5%:

- Charitable organisations.

- Where electricity or gas is used for domestic purposes.

- Small organisations that use less than 145kWh of gas or 33kWh of electricity per day on average

What to do if I can’t find my business energy bills?

If you haven’t received a business energy bill recently, we recommend requesting one from your supplier’s customer services department.

See our ultimate guide to business energy suppliers for your supplier’s contact information.

How does backdating work in relation to your business energy bill?

Sometimes, your business gas supplier must backdate your commercial energy bill if you’ve underpaid. Backdating can happen when you have been paying an estimated business energy bill rather than submitting regular meter readings.

An example would be that you pay £1,000 per month on your estimated bills; however, when you provide meter readings, your supplier calculates that you’ve more energy than your supplier initially estimated.

Your business energy supplier will increase your bill to cover the additional business energy usage in the previously billed period.

How can my business energy bill be exempt from the climate change levy?

The following types of organisations are exempt from paying the climate change levy on a business energy bill:

- Small businesses energy customers who use less than 4,397 kWh of gas or 1,000 kWh of electricity each month.

- Charities

- Community heating schemes

- Domestic users

- Some types of transportation companies

- Energy distribution and generation companies.

For more information, here’s our full guide to the climate change levy.

What are the hidden costs on my business energy bill?

Some business energy bills include broker commissions within the unit rates applied on the consumption charges section of the bill.

Although not typically presented on a business energy bill, the broker commission you’ll pay will be disclosed on the business energy contract that you’ve signed.

For more information, here’s our guide to business energy brokers.

Are there any governmental incentives for reducing my business energy bill?

Business energy grants can be used to support a few different types of investment that reduce the charges on your business energy bill; here are some examples:

- Upgrading your commercial building, like improving insulation or replacing an air conditioning system to make it more energy efficient.

- Replacing your gas boiler with a heat pump to reduce business gas consumption.

- Investing in commercial solar panels to reduce your consumption of mains electricity.

For more information, we have a full guide to business energy grants.