The UK’s energy mix: Key trends over the last 25 years

This guide explains the UK’s energy mix and the key factors that have shaped how the country has generated electricity since 2000.

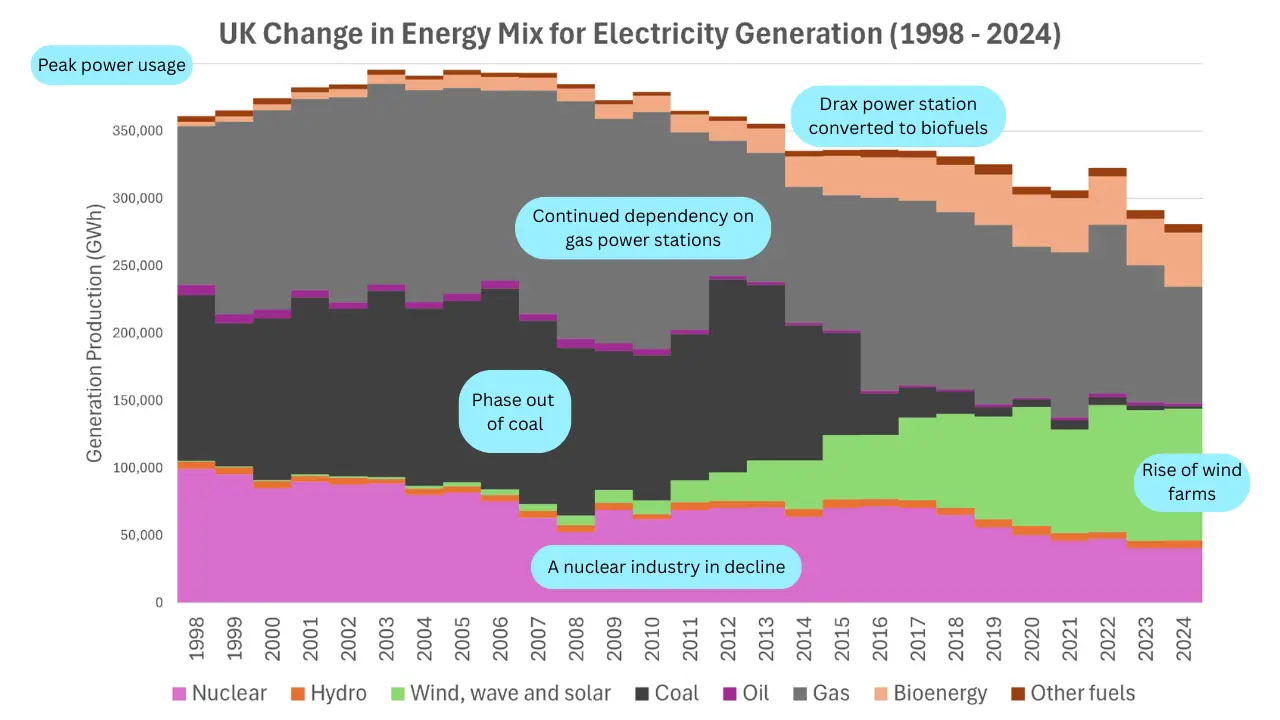

The graph below has been compiled by our experts using UK Government statistics to illustrate the significant changes in the UK’s energy mix over the past 25 years.

Overview of the UK energy mix

The UK energy mix is the combination of different energy sources used to meet total electricity demand on the national electricity grid.

The UK grid supplies over 250,000 GWh of electricity each year to homes and businesses. This electricity is generated from a combination of fossil fuel-based power stations, nuclear power and renewable energy sources.

The composition of the UK’s energy mix has direct implications for:

- Carbon emissions – Different sources of electricity have significantly different greenhouse gas emissions.

- Energy security – The energy mix determines how reliant the country is on imported fuels.

- Consumer costs – The electricity mix directly affects domestic and business electricity prices paid by consumers.

How the UK’s energy mix has changed over time

The UK’s energy mix has changed significantly over the past 25 years. It has been shaped by the following policy, economic and technological factors.

Net zero government policy

The Climate Change Act 2008 was landmark legislation that made the UK one of the first countries in the world to set legally binding limits on greenhouse gas emissions.

A key part of the strategy to reach net zero by 2050 is to decarbonise electricity generation. This has involved the following schemes and support mechanisms:

- Renewable incentives – Heavy subsidisation of renewable energy through the Renewables Obligation and the Contracts for Difference scheme.

- Carbon taxation – Taxes on industries, including power generation, that emit large volumes of greenhouse gases.

Domestic natural gas production

In the late 1990s, a boom in gas production in the North Sea made the UK largely self-sufficient in natural gas, making gas-fired power stations a relatively cheap and secure source of electricity generation.

Domestic gas production peaked in 2000 and then gradually declined. By 2004, the UK had become a net importer of gas.

Growing dependence on imports has linked UK gas prices more closely to international markets, making gas-fired power stations more expensive and strengthening the economic case for alternative power sources.

Reducing overall power demand

The UK’s total electricity consumption peaked in 2005 and has gradually fallen since.

The decline in overall electricity consumption has been driven by:

- A reduction in electricity-intensive industries, such as steel, chemicals and manufacturing, which have been offshored.

- Improvements in the energy efficiency of devices in domestic and commercial properties.

A reduction in overall electricity demand has reduced the need to build new large-scale baseload power stations in the UK.

Phase out of coal in electricity generation

The single biggest change in the UK’s energy mix relates to the use of coal.

In the mid-20th century, electricity generation was overwhelmingly coal-fired. At that time, domestic coal mining was a major industry in the UK, making coal a cheap and reliable source of energy. Climate change was not yet a policy concern, and local air pollution was tolerated.

The dominant position of coal began to erode in the 1990s, when North Sea gas production increased rapidly, and combined-cycle gas turbine (CCGT) technology became commercially viable, making it a cheaper energy source than coal.

Between 2000 and 2020, the use of coal declined to near zero as a result of a combination of:

- An ageing fleet of coal-fired power stations is becoming uneconomic to maintain.

- EU air quality and emissions regulations.

- Carbon pricing, including the emissions trading scheme, made it more expensive to operate a coal-fired power station.

An ageing nuclear industry in the UK

Over the past 25 years, the contribution of UK nuclear power stations has decreased from 26% in 1999 to approximately 15% today, generated by just five active nuclear power stations.

Construction of the UK’s most recent nuclear power station was completed over 30 years ago, with Sizewell B in Suffolk finishing in 1995. Since then, three nuclear power stations have reached the end of their operational lives and entered the defueling phase.

Despite recent extensions to their operational lifespans, the UK’s five remaining nuclear power stations are all expected to close within the next decade.

| Power station | Location | Capacity (MW) | Operational since | Expected closure |

|---|---|---|---|---|

| Sizewell B | Suffolk, England | 1,198 | 1995 | 2035 |

| Heysham 1 | Lancashire, England | 1,155 | 1983 | 2027 |

| Heysham 2 | Lancashire, England | 1,230 | 1988 | 2030 |

| Hartlepool | County Durham, England | 1,180 | 1983 | 2027 |

| Torness | East Lothian, Scotland | 1,190 | 1988 | 2030 |

Nuclear industry held back by privatisation

All of the UK’s current fleet of nuclear power stations was directly funded by the government before the privatisation of the energy industry.

Building a new nuclear power station is a capital-intensive process that typically takes more than a decade to complete.

The financial risks involved, combined with the growth of relatively cheap gas-fired power stations, led private investors to conclude that new nuclear capacity was not economically viable.

Nuclear resurgence under construction

Following the agreement of significant government subsidies, two major nuclear power stations are currently under construction on the sites of existing stations: Sizewell C and Hinkley Point C.

Each of these power stations is expected to contribute around 7% to the UK’s overall electricity mix when they come online in the 2030s.

Both stations are being constructed by the business energy supplier EDF and will provide low-carbon baseload electricity to the grid, helping to offset the loss of generation from the expected closure of the current nuclear power fleet.

The UK government is also investing in early-stage small nuclear reactor technology, which could deliver modular reactors capable of supporting the grid in the future.

Rising contribution of UK wind farms

In 2025, UK wind farms contributed nearly 30% to the overall electricity mix, dwarfing other renewable sources (solar PV: 6%; hydro power: 2%).

The dramatic increase in wind power’s contribution has occurred over the past twenty years. In 2004, wind power contributed less than 0.5% of the UK’s electricity generation.

Supported by renewable subsidies and advances in wind technology, wind power has become a significant source of electricity in the UK, driven by exceptional wind energy resources across the British Isles, in particular:

- Strong, consistent winds

- Large areas of shallow offshore waters, especially in the North Sea

- Proximity of offshore sites to major demand centres

The Government’s Clean Power 2030 plans

The UK is a global leader in wind power, and this energy source is central to the UK Government’s Clean Power 2030 target, which aims to:

- Triple offshore wind capacity to 43–50 GW

- Double onshore wind capacity to 27–29 GW

If these plans are delivered, wind power will dominate the UK electricity mix in the future. This increase must be accompanied by the development of grid-scale energy storage facilities to help balance intermittent wind generation.

The conversion of the Drax power station to run on biomass

Drax Power Station was the largest coal-fired power station in the UK and, at its peak, produced around 8% of the UK’s electricity.

Between 2013 and 2018, Drax converted several of its generating units to run on compressed wood pellets, a form of biomass energy.

Drax’s generation capacity means this single power station accounts for most of the UK’s biomass based electricity generation.

Electricity generated at Drax is classified as renewable and earns Renewable Energy Guarantees of Origin, as wood pellets absorb carbon dioxide from the atmosphere during the growth phase of trees.

Unlike other renewable energy sources, the output of Drax is not weather-dependent, meaning it can help to balance the rising contribution of intermittent wind generation.

Continued dependency on gas power stations

The contribution of gas-fired power stations to the UK’s energy mix peaked in 2010 at 46% and has since declined gradually to approximately 30%.

Gas-fired power stations generate electricity by combusting natural gas. Despite subsidised renewable biogas production through the Green Gas Support Scheme, the gas delivered to power stations via the national transmission system remains almost entirely from fossil fuel sources.

Gas-fired generation is currently the most carbon-intensive form of electricity generation in widespread use on the grid.

The grid’s reliance on gas-fired power stations remains significant, as they provide:

- Dispatchable generation on demand

- The ability to rapidly ramp generation up or down to offset changes in wind output

- Reliable output during cold, low-wind periods

The route away from natural gas dependency

The UK Government’s Clean Power 2030 plans aim to reduce the contribution of unabated gas-fired power stations (those without carbon capture) to below 5%.

Under the plan, the UK will not shut down gas-fired power stations but will instead rely on them primarily as a back-up power source during periods of low wind generation.

The reduction in dependency on gas-fired power stations is expected to be driven by:

- Rising wholesale gas prices, which have increased significantly since 2022, making gas-fired power stations less competitive

- Continued substantial subsidies for nuclear and renewable power generation

- Ongoing improvements in solar technology, making it more viable at scale in the UK climate.