The new UK coal mine that makes no sense

Nestled in the picturesque landscape of Cumbria, the recently approved Whitehaven colliery is set to become the first deep coal mine in Britain in over thirty years, going against decades of progressive policies that earnt the UK hosting rights for COP 26 in 2021.

In our eyes, a new coal mine would only make sense in truly exceptional circumstances if there was a really strong strategic and security reason for doing so.

However, we haven’t really found any strong excuses for a coal mine – let us uncover why, point by point!

Contents

- Who wants employment in a dying sector?

- A mirage of energy security

- A dubious business case

- The world does not need UK coal

- The cost of coal mining emissions

- A dent to the UK’s declining environmental credibility

- Conclusion

Who wants employment in a dying sector?

The coal mine is projected to generate at least 500 direct jobs and a couple of thousand indirectly through supporting industries, particularly for the local area.

This is positive for local employment, particularly when considering that the district of Copeland has higher unemployment than the national UK average (Copeland: 5.1% unemployment; UK average unemployment: 4.9%).

However, creating new coal mining jobs and services may backfire, given that it is essentially a dying industry that doesn’t have a place in net-zero by 2050.

We don’t deny that SOME coal will always be necessary to the national and international markets and that having some local coal production is strategically sound on paper, but as we will see later, there are many reasons why the business case for this particular mine is not strong.

Based on this, we speculate that if this mine opens, there is a risk it may be shut down very soon after, leaving dedicated locals with skills not applicable elsewhere unless they move to the burgeoning coal mines of China, India, the US or Australia.

The global narrative around climate change requires jobs around renewables, well-being, and outdoor activities- none of which are intuitively transferable with coal mining skills.

The local area is renowned for having a diversified labour market thanks to the Cumbrian nuclear industry and the tourism of the Lake District. Adding coal mining jobs would indeed diversify this even further; we just believe that it’s the wrong path to explore!

A mirage of energy security

Another pro argument for the mine stems from an energy security perspective. Having national coal production is essential to meet coal demand during any black swan event such as war, embargos, national disasters, etc.

We think that this sounds great on paper (particularly to those who are in favour of a nationalist narrative), but in reality, there isn’t a strong case for this because coal power will no longer be part of the UK electricity mix.

There is only a single coal power station remaining in the UK, which is kept ready for when the supply of electricity cannot meet demand. This coal power station is due to shut down in 2024, meaning there is little need for ongoing coal production in the electricity sector, which is rather turning to electricity storage solutions such as PSH and CAES.

And even in the case that the government decides to keep one coal power station idle indefinitely, the reality is that coal is an imperishable fuel that can be stored indefinitely in a coal store. This is much cheaper than spending millions of dollars and emitting millions of tonnes of carbon in the UK (which will be expensive anyway due to oncoming carbon premiums).

A dubious business case

The main business case for the mine is in selling the 2,8 million tonnes of coking coal it will produce a year to the UK steel industry, but senior members of the steel industry have publically stated they are not interested in purchasing any of it.

There are only two operational furnaces left in the UK, both of which have publically voiced their preference for purchasing high-quality coal from the international market, with the coal from the Whitehaven site being unsuitable due to its high-sulphur content.

Changing coal suppliers is not the industry’s main priority, having made promises to reach net zero by 2035 to be in-line the UK’s targets set by the Committee on Climate Change, which means that money is flowing to developing the necessary technologies for this, like arc furnaces and green steel.

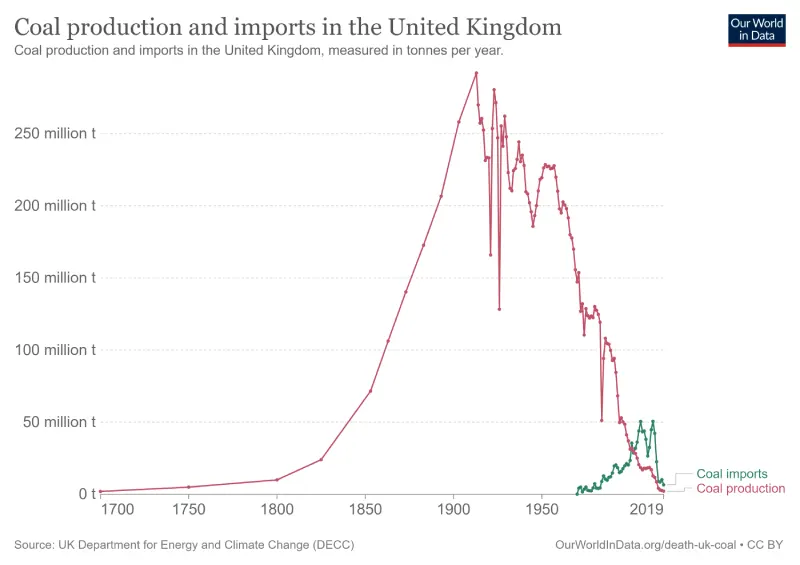

This is not only reflected in the steel industry but in others like concrete manufacturing, where alternatives such as cleancreteare trying to reduce the role of coal. For context, the UK has reduced its coal consumption from about 64 million in 2012 to 2.9 million tonnes by 2020.

Opening a coal mine without a clear buyer would ultimately prove catastrophic for local employment and the national economy, especially considering that Brexit has made selling coal to the EU unfavourable and that EU legislation is underway to penalise imported coal and other high-carbon imports.

The world does not need UK coal

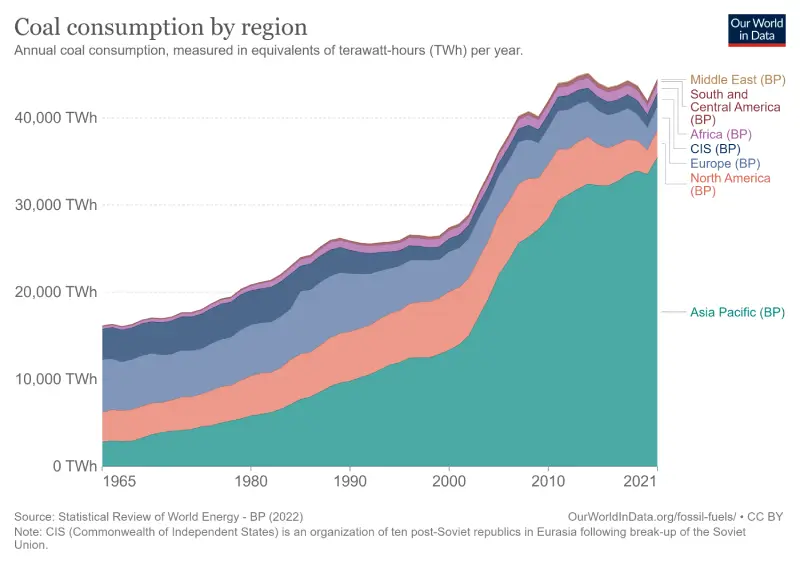

To be fair, the media in the West is grossly misrepresenting the global energy transition, and coal is still central to the global electricity mix, producing 37% of global electricity in 2021.

Whilst the UK has dramatically reduced its coal power output to virtually zero, other countries like China still consume over 4 billion tonnes of coal to produce electricity while simultaneously having the largest renewables and nuclear capacity worldwide.

China is doing its best to decarbonise its power grid, but it’s just too big to do it as fast as the UK (whose electricity usage has actually been going down over the years).

We digress; what we are trying to say is that there is already enough coal in countries that still use it and there is no reason why any of these countries would purchase expensive, low-quality (high sulphur!) Cumbrian coal.

This becomes perfectly clear when looking at the recent tumble in the international price of coal, reflecting an excess in global coal supply relative to demand. And in a transitioning world, prices are likely to keep decreasing in the long run.

The cost of coal mining emissions

Something that is often left out of starting a new fossil fuel project is the unavoidable costs of carbon emissions, which add a new problem to the weak business and economic case for opening a new coal mine in Cumbria.

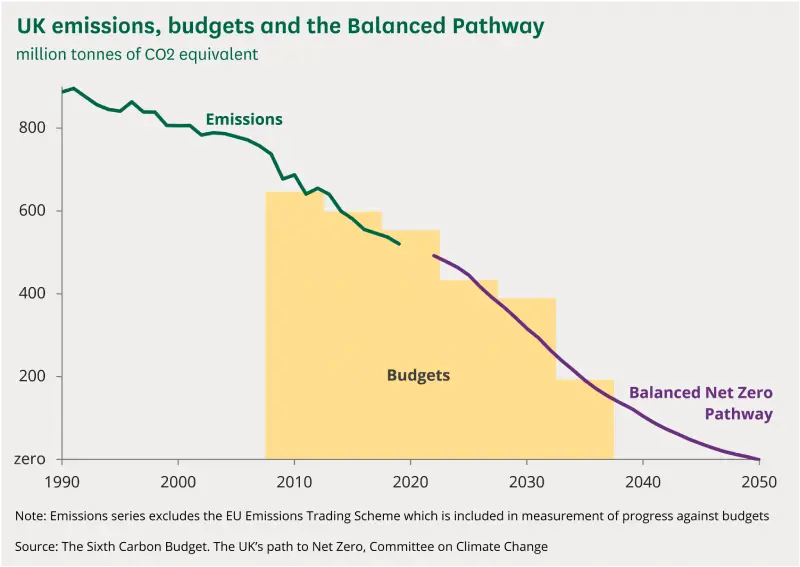

This is because the UK has to purchase carbon offsets for any carbon emitted above its national budget for each year as defined by the UK ETS (Emission Trading Scheme).

The UK has a concrete plan for net-zero emissions by 2050 that involves reducing emissions year-on-year, and adding a coal mine will make this more difficult and expensive, especially considering that the price of carbon is expected to grow over time.

Many fail to realize that coal does not only emit carbon when it is consumed but also when it is mined. When underground coal seams are disturbed, the methane trapped in the rock’s pore spaces is released in a process called “fugitive methane emissions”.

It is estimated that the small mining operation at Whitehaven may release 17,500 tonnes of methane yearly through this process.

Methane has a global warming potential of around 28x that of carbon dioxide, which is equivalent to emitting nearly 500,000 tonnes of CO2 every year!

A dent to the UK’s declining environmental credibility

Another issue that mine proponents ignore is that one of the UK’s remaining strengths is its environmental credibility, thanks to its burgeoning renewables portfolio and its successful policies to reduce coal.

This reputation is what earned the UK the right to host the 2021 COP conference in Glasgow ahead of other candidates. These global events improve a country’s standing as a leader and bring in money through tourism and hospitality and business possibilities for green tech businesses in the region.

Opening a new coal mine would surely dent the reputation that the UK has built over the last couple of decades.

And this goes without mentioning the real environmental risks inherent to even the best-regulated coal mines such as habitat destruction, water pollution and soil degradation.

Conclusion

Given the points above, it is difficult to argue how building a coal mine benefits the UK.

The business case is flawed in all scenarios, and any benefits to the economy are immediately offset by the hidden carbon emissions costs of the project.

If the project goes ahead and it fails, it may leave the local economy of Whitehaven worse off than before.

External Resources:

- Channel 4 – Cumbria Coal Mine – May 2022

- UK Gov – Approval on 7 December 2022

- The Guardian – Cumbria Coal Mine – December 2022

- Nomis Statistics – Labour market Copeland

- The Guardian – Coal until 2024

- Ourworldindata – Coal

- Ourworldindata – Electricity Mix

- Trading Economics – Coal price

- The Guardian – Cumbria Coal Mine

- The Guardian – Steel Boss dismissal

- The Guardian – Cumbria Coal Mine 2

- Committee on Climate Change

- Ourworldindata – Deaths per unit electricity

- Ourworldindata – Death of UK coal

- Ourworldindata – Coal consumption by region

- UK Comons library