Business Gas Prices

Compare April 2024 Gas Prices and save up to 45% Today

Just enter your business postcode…

Compare April 2024 Gas Prices and save up to 45% Today

Just enter your business postcode…

Business gas prices in April 2024 – the table below shows average business gas prices per kWh offered on one-year fixed contracts in April 2024.

| Size | Annual Consumption kWh | 1 Year fixed gas rate p/kWh |

|---|---|---|

| Small | 10,000 to 50,000 | 5.9 |

| Medium | 50,000 to 100,000 | 5.4 |

| Large | 100,000 + | 5.2 |

Important note: The information above is based upon the latest published wholesale gas data but does not represent live gas prices. Business gas rates change daily and are location-dependent. To get today’s business gas rates, start by entering your postcode below.

Source: The above data has been compiled using:

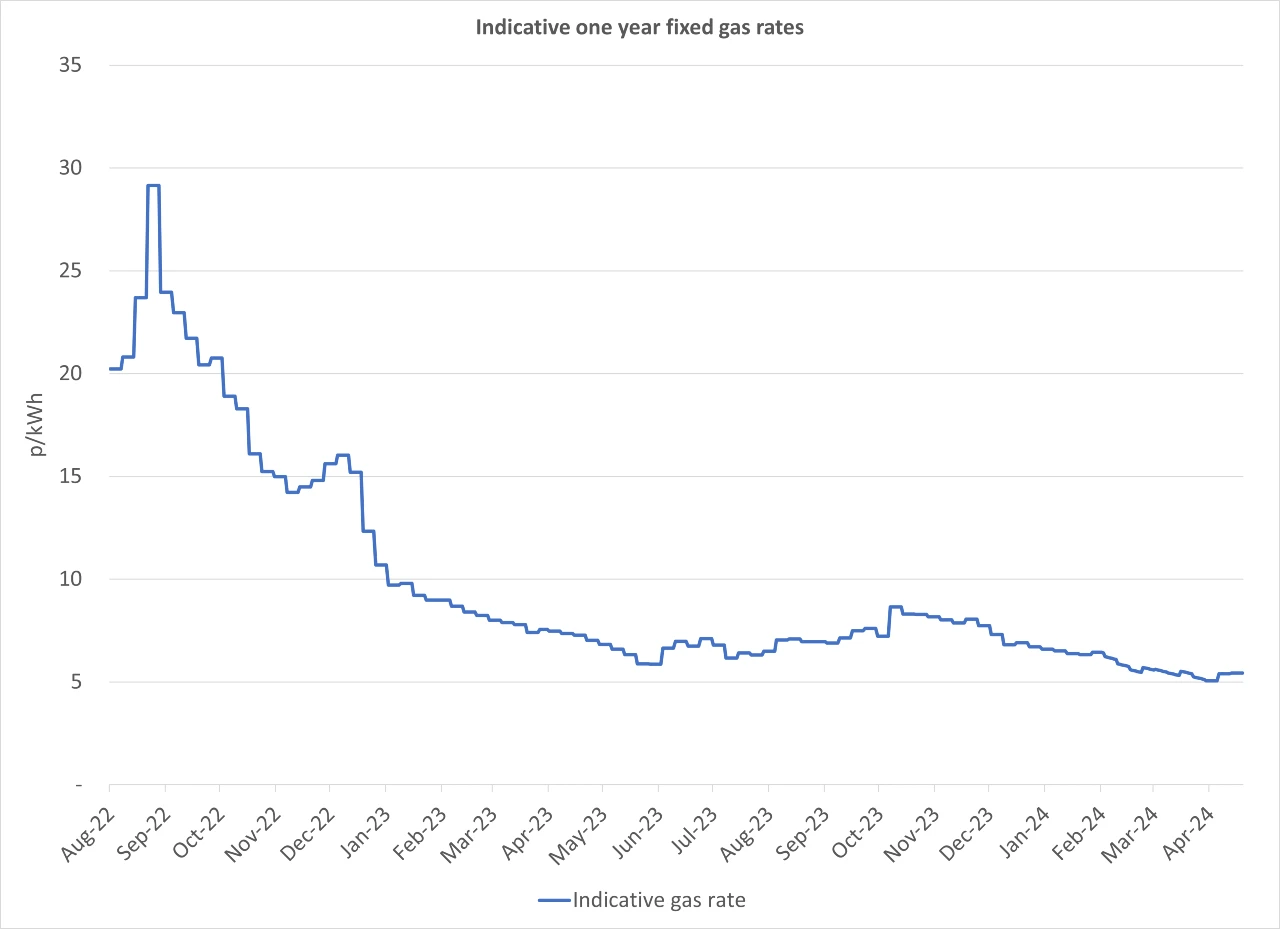

Current business gas rates in the UK and their trends over the last year are shown below in our graph, updated weekly by our experts:

Average business gas rates in the UK are shown in our table below. The data consists of one-year fixed gas rates offered by business gas suppliers in 2024 compared to the previous three years.

| Size | Annual Consumption kWh | 2021 average rates p/kWh | 2022 average rates p/kWh | 2023 average rates p/kWh | 2024 average rates p/kWh |

|---|---|---|---|---|---|

| Small | 10,000 - 50,000 | 5.07 | 16.31 | 8.91 | 6.32 |

| Medium | 50,000 - 100,000 | 3.65 | 15.87 | 8.51 | 5.83 |

| Big | 100,000 + | 4.28 | 15.62 | 8.36 | 5.63 |

Source: The information above is based upon the latest wholesale gas prices published on the ICE exchange and average non-commodity costs as per AquaSwitch quoting data.

Business gas prices quick links:

A good business gas rate depends on several factors but is especially influenced by wholesale gas markets.

In the 2010s, business gas rates were as low as 2p/kWh but have risen significantly since the onset of the Ukrainian conflict in 2022. See the latest business gas rates above.

Geopolitical events always influence business gas rates, and predicting future gas prices is challenging. However, we can help you get the best business gas rates in today’s market with our business gas comparison service.

Yes, business gas prices fell significantly in 2023. The chart above shows how business gas prices per kWh have changed over the past year.

With wholesale gas prices falling back towards normality, it’s a great time to find out what deals are available to your business. Get quotes tailored to your business today with the AquaSwitch business gas comparison service.

The biggest factor determining business gas prices is how much gas your business consumes. All business gas tariffs charge for each kWh of gas that flows through the gas meter at your commercial property.

As a guide, here are the annual figures for the average business gas usage:

| Business Size | Average Annual Gas Consumption (kWh) |

|---|---|

| Micro | 5,000 |

| Small Business | 15,000 |

| Medium Business | 35,000 |

| Large Business | 75,000 |

| Industrial | 500,000 |

| Average British Home | 12,000 |

Choosing the right business gas supplier and tariff is vital for business owners as it directly affects how much you need to pay on your business gas bills.

Unlike the household energy market, no price cap protects business gas rates. If your business pays a standard variable tariff, gas rates could be twice as much per kWh as the fair market price.

Business gas rates are a significant cost for most companies, so we’ve produced this ultimate guide to business gas rates and prices to give you all the information you need.

Business gas rates are the set of charges that companies pay for a business gas supplier to provide a gas supply through the mains network.

Here are the key components of simple business gas rates:

Business gas rates in 2024 remain approximately double the rates paid by businesses before 2021. Our experts summarise the key factors contributing to the high cost of business gas rates:

The UK possesses natural gas reserves in the North Sea, but these are in decline and are expected to be completely depleted within the next 15 years.

In 2006, the UK lost its self-sufficiency in natural gas when consumption exceeded North Sea production for the first time. As production continues to decline, the gap between consumption and production widens further. Currently, the UK imports around 40% of its natural gas from other countries.

Since the start of the war in Ukraine in early 2022, Russia, the world’s largest gas exporter, has restricted its usual plentiful and cheap supply of natural gas into Europe.

With the reduced Russian supply, the demand for gas in Europe has significantly exceeded the continent’s available natural gas production, leading to increased prices.

In the last decade, the UK has been reliant on purchasing natural gas from continental Europe through interconnecting pipelines to make up for the falling production in the North Sea.

To substitute gas imports from Europe, the UK now imports liquid natural gas on ships from America and the Middle East, which is introduced to the national gas grid at three LNG regasification terminals on the British coast.

Importing natural gas by ship is significantly more costly than transporting gas via pipelines overland. This method of importation has led to a marked increase in the cost of gas for both homes and businesses in Britain.

Source: BEIS – Supply of Liquefied Natural Gas in the UK

The cost of 1 kWh of business gas varies depending on several factors, including the supplier, location, tariff, and state of the wholesale gas market.

In the last year, the market’s cost of 1 kWh of business gas has ranged from 6 to 12 pence.

Find out the current business gas rates available for your business.

The government’s quarterly publication of energy prices consistently shows that micro businesses pay higher gas prices per kWh than larger businesses.

Ofgem, the regulator, says this is because “the complexity of the market, with its wide variety of contracts and lack of accessible information about prices, means some microbusinesses find it hard and costly to engage in the market to find a better deal.”

At AquaSwitch, we make it simple for micro businesses to find the best deals. For more information, check out our guide to small business energy.

Source: Ofgem strategic review of the microbusiness retail market.

Yes, large businesses typically enjoy cheaper commercial gas prices compared with SMEs and other smaller companies.

This is primarily a matter of purchasing power. As with any goods bought in bulk, the more you buy, the cheaper prices you get. Large businesses receive bespoke quotes when looking for a new gas tariff reflecting lower ‘bulk buy’ price

Understanding your business gas bill can be complicated. On the final page of your bill, your supplier will give you a ‘details of charges’ section showing how each element of your business gas rates has been calculated.

To help demonstrate how business gas rates work, our in-house experts have built a handy business gas rates calculator below.

The biggest confusion in business gas rates is that suppliers charge per kWh of gas used by your gas meter measures gas volume, in either cubic meters or feet.

Our business gas prices calculator aims to cut through this confusion by calculating the conversion between your meter readings and kWh. Here’s how it works:

Metric meter gas consumption calculation:

Imperial meter gas consumption calculation:

Where:

Most small businesses opt for the security of fixed-rate gas tariffs and benefit from locking in cheaper rates.

The reason fixed rates are typically the cheapest is that suppliers offer their best prices on these tariffs to attract new customers. Continue reading for a summary of the three key benefits of business energy tariffs.

A fixed-rate business gas tariff is the most popular option for SMEs, and here are the three key benefits of choosing a fixed price tariff:

Responding to the energy crisis of 2022, the UK government introduced two schemes that automatically discounted business gas bills:

These government support schemes have now ended and have not been replaced.

Without government support on business gas prices, it’s important to secure the best deal from the open market. Use our comparison service to find the best business gas rates today.

Our business gas experts answer all the common questions on business gas rates.

Not all business gas rates come with a standing charge. If you get priced with a standing charge, you can contact your supplier and discuss having gas rates with no standing charge. However, this is usually offset by a higher unit rate.

A zero-standing charge gas tariff isn’t necessarily the cheapest option, depending on your commercial gas consumption.

We advise you to shop around, compare business gas prices, and understand exactly what you’re looking for in your new supplier.

No, the British government does not impose price controls on the business gas market. In contrast, for households, Ofgem regulates the gas suppliers with an energy price cap, ensuring they cannot charge more than a maximum unit rate and standing charge.

The absence of a business energy price cap means that out-of-contract business gas rates are significantly more expensive than the typical fixed gas rates offered to new customers. To avoid these costly default variable gas rates, we recommend regularly comparing the business gas market for the latest fixed rates.

All business gas tariffs have a unit charge per kWh of gas consumed, so the easiest way to get cheaper business gas rates is to use less gas simply. Here are a few quick tips for reducing your business gas rates through lower consumption:

Once you’re satisfied with your gas efficiency, the next step is to get the best deal for your gas supply. We recommend using a business gas comparison service to quickly collect quotes from across the market.

There are a few elements that affect the price of business gas. Here are three key factors that determine business gas rates:

Read our monthly report on the business energy market.

If you’re on a variable rate contract, you will, unfortunately, be riding the highs and lows of the business gas market, and some days you’ll be paying considerably higher rates than other days.

As long as your business is locked into a fixed rate business gas contract, they can’t. During a fixed-rate contract, your supplier cannot increase their business gas price per unit kWh.

A few exceptions exist to the rules around fixed rate business gas contracts. Check out our article on unexpected increases in business energy contracts.

It depends on multiple factors. Finding the best business gas prices depends on your annual gas consumption and the size and location of your business.

It’s best to shop around and compare gas prices to ensure you get the best deal. Other factors that will affect your prices are the length of the contract and the unit prices when requesting a quote.

It’s difficult to say which business gas supplier has the cheapest rates and prices. Prices fluctuate multiple times daily and depend on location, usage, tariff type, and many other factors.

We recommend using our business gas comparison tool to compare the latest prices and find the cheapest business gas rates available for your business today.

The government’s latest energy prices data directly compared business and home gas bills. Here’s what they found in 2022:

Business gas supplies were £197 ( ~15% ) cheaper than those for households. The prices shown assume 13,600 kWh of annual gas consumption in both cases.

Business gas prices per kWh are usually cheaper as businesses typically sign up for a longer contract than your average household.

This means the supplier can buy the entire contract’s worth of gas in bulk at a cheaper rate and pass any savings onto the business.

However, unlike homes, companies pay VAT at the standard rate and the climate change levy on top of their gas bills.

The standing charge in a business gas tariff is charged daily regardless of whether your business actually uses any gas. This fixed charge can seem like an unnecessary daily expense, but it’s worth remembering the business gas standing charge pays for:

Most buildings in the UK are designed to rely on gas for heating purposes, but some are already beginning to phase this out in anticipation of net-zero by 2050 by:

Businesses served by the East Midlands gas distribution network enjoy the cheapest gas rates per kWh.

Cadent Gas operates the East Midlands gas distribution network and has the cheapest network costs, a significant component of business gas rates.

Business gas rates were much cheaper two years ago before tensions in Ukraine started to ramp up.

The Government’s July to September 2021 energy price update shows that businesses paid an average rate of 2.91p/kWh for gas supplies two years ago. Business gas rates are now significantly higher than this figure.